If you’re a plumber, hairstylist, or freelance consultant in Texas, you probably didn’t start your business because you love spreadsheets. You started it because you’re great at what you do—and people need you.

But then taxes roll around. Or you apply for a loan. Or you finally look at your bank account and think, “I have no idea what any of this means.”

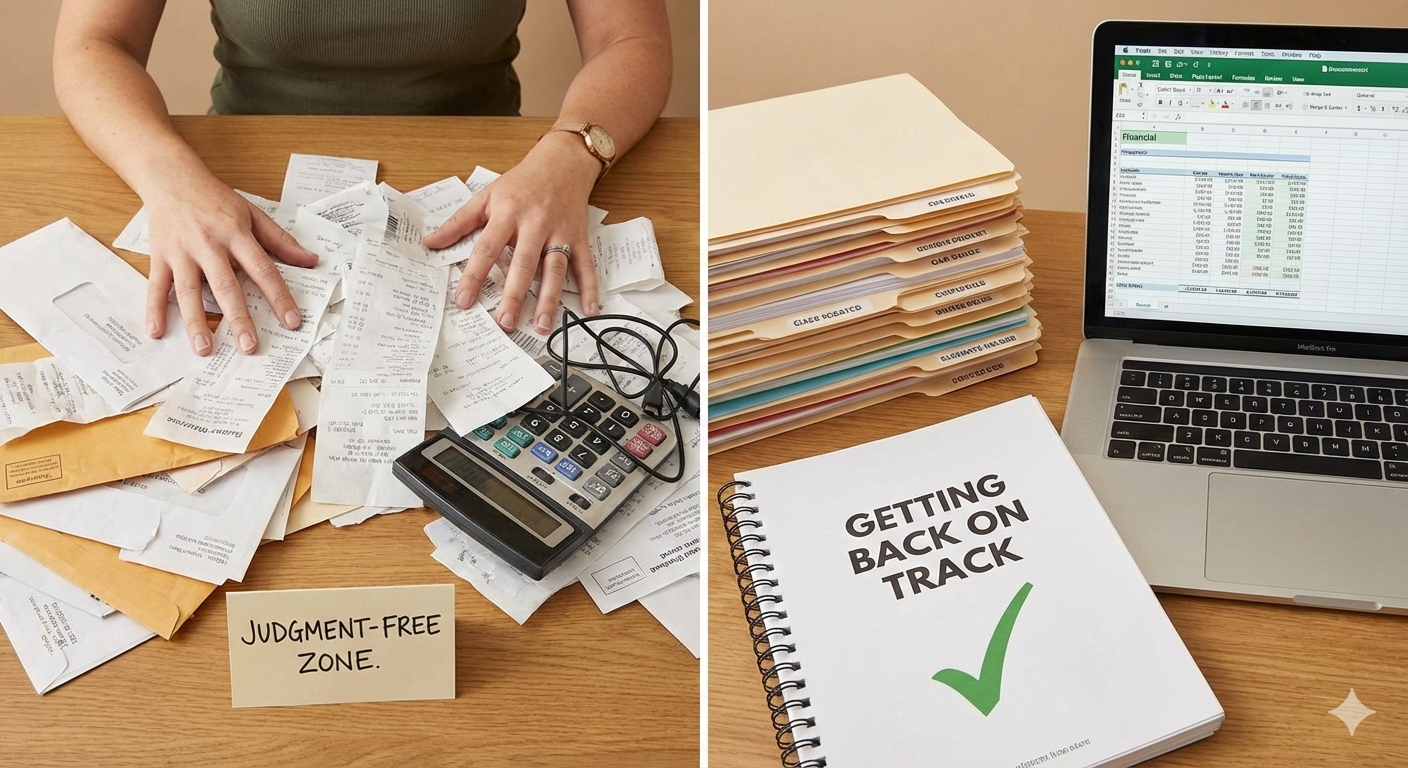

If your books are “messy,” you’re not alone. And you’re not a bad business owner. You’re just a busy one.

What “messy books” usually looks like

Most “messy books” aren’t a moral failure—they’re a system problem.

Here are the most common signs:

- A shoebox (or grocery bag) of receipts you’ve been avoiding

- A bank account that hasn’t been reconciled in months

- Personal and business spending mixed together

- Income that looks “fine” until the slow season hits

- No idea what you should be saving for taxes

- A sinking feeling every time you hear the words profit and loss

Sound familiar? You’re in the right place.

Why it feels so scary (and why you avoid it)

Let’s be real: finances can feel personal.

A lot of business owners avoid their books because they’re afraid of two things:

- Judgment: “A CPA is going to lecture me or make me feel stupid.”

- The cleanup bill: “If I show someone this mess, it’s going to cost a fortune.”

That fear makes you delay.

And delaying makes things messier.

And then the fear gets bigger.

It’s a cycle—and it’s exactly why a judgment-free approach matters.

The real cost of messy books (it’s not just stress)

Messy books don’t just make tax time harder. They can quietly cost you money all year.

- You might be overpaying taxes because deductions aren’t tracked

- You might be underpaying taxes and not realize it until it’s a problem

- You can’t confidently price your services without knowing your real costs

- You can’t plan for slow months if you don’t know your cash flow

- You can’t make smart decisions when you’re guessing

The goal isn’t perfection. The goal is clarity.

The “taxes are due” reality: you can’t file until the books are done

This is the moment most people reach out: “I need to file taxes, but I can’t even tell what I made.”

Here’s the truth: your tax return is only as good as the information behind it.

If your income and expenses aren’t organized, your tax prep becomes:

- slower

- more expensive

- more stressful

- more likely to miss deductions

Getting your books caught up first is the fastest path to getting taxes filed with confidence.

A judgment-free way to start (even if you’re overwhelmed)

You don’t need to fix everything tonight. You just need a first step.

Here’s a simple, low-stress approach:

- Pick a starting point: Choose one month to tackle first (not “the whole year”).

- Gather the basics: Bank statements, credit card statements, and any receipts you can find.

- Separate going forward: If you don’t have a separate business account yet, make that your next move.

- Stop the bleeding: Set up a simple system for receipts and mileage so the mess doesn’t keep growing.

Progress beats panic every time.

What it’s like to work with a “judgment-free zone” bookkeeper

The right support should feel like relief.

A judgment-free bookkeeper doesn’t shame you for what happened. They help you:

- get caught up without overwhelm

- understand what your numbers actually mean

- build a simple system you can keep up with

- stay tax-ready going forward

You deserve someone who can meet you where you are, explain things in plain English, and help you move forward.

If you’re a Texas business owner with messy books, here’s your next step

If you’ve been putting this off because you’re embarrassed or afraid of the cost, take a breath.

You don’t have to be “ready.” You just have to be willing to start.

Your books can be cleaned up. Your taxes can be filed. And you can feel confident about your business again.

If you want help getting caught up—without judgment—reach out and let’s talk through what’s going on and what a realistic cleanup plan looks like.